The following is a guest post from Christina Comben.

I first met Mark Moss at the entrance to the media center by the main stage at Bitcoin MENA in Abu Dhabi, the first official Bitcoin conference in this part of the world. We haven’t met before but from his familiar drawl, infectious personality, and volumes of insightful content (including a YouTube channel and best-selling book The Uncommunist Manifesto), I feel I know him already.

Mark has been championing the benefits of Bitcoin to anyone who will listen since 2016 and was a serial entrepreneur long before.

“I started a business in 1999 at the height of the dot-com boom. That crashed. I started another business in 2001, an e-commerce business, it wasn’t easy,” he laments. “It was terrible timing. Everyone laughed at me and said, no one would ever buy anything online. I built that up and had a big exit on it.”

From Orange County to Abu Dhabi

What brings him to Bitcoin MENA in UAE’s opulent capital all the way from his home in Orange County?

“I’m an educator and content creator,” he says. “I’m also a partner at a Bitcoin Venture Capital fund, so we invest in the businesses building on and around the Bitcoin ecosystem. I also have a new company that just went public in Canada called Matador, and that’s running a Microstrategy play with Bitcoin as a balance sheet asset and investing through the Bitcoin Layer 2 space. So I’m actively educating and investing in the space to try to build the world that I want to see.”

What kind of a world is that? For Mark, it’s firmly Bitcoin, not crypto. He’s been on the altcoin rollercoaster but sees no other cryptocurrencies with “long-term” staying power. “I certainly made a lot of money,” he says, “a lot of money,” he repeats with added emphasis. I wait for him to share the usual cautionary tale of holding a stash down to zero or getting rugged at the sh**coin casino, but he says:

“In 2017 and 2018, we were competing for Layer 1s. Ethereum, Cardano, Litecoin, NEO… well, Bitcoin won that. So then the crypto narrative went to DeFi and that all fell apart, then crypto went to NFTs, and that all fell apart, and now it’s meme coins. No one’s pretending that’s world-changing technology.”

He concedes that meme coins (and altcoins in general) may serve some purpose as a “gateway drug” in bringing people over to Bitcoin. “People come for the money and they stay for the freedom,” embarking on their Bitcoin journeys and discovering why they need permissionless, censorship-resistant money in the first place.

“I think stablecoins lead to that as well,” he says, “eventually people get used to having a wallet and transferring digital assets, but then they wonder why their U.S. dollar stablecoins buy them fewer goods and services, and why Bitcoin buys them more, and I think eventually it all sort of funnels over.”

The Flawed Fiat System and the Magic Money Printer

Mark says the main problem with fiat is that it has no cost of capital.

“When you start to understand money, you understand that if printing money made people wealthy, why don’t we just print a lot more? Money has to have a true cost of capital. So gold, for example, I have to buy land and get equipment and spend energy and capital to get the gold, with Bitcoin, new coins are only released if you spend the money and do the work to get them. So the capital has to have a true cost. You can’t just print money out of thin air, otherwise, we’d all be rich.”

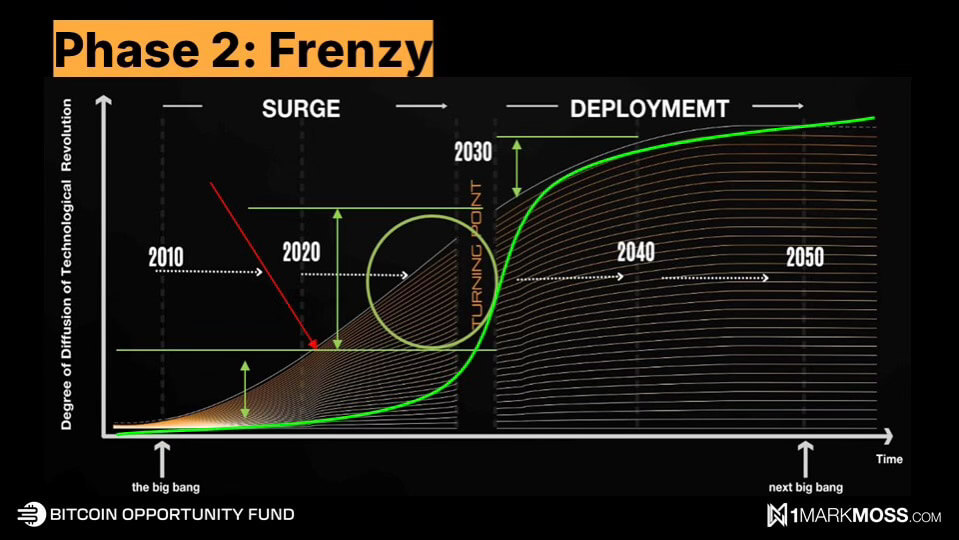

He points to the S-curve model for measuring Bitcoin adoption.

“The way an S-curve works is the time it takes to get to 10% adoption is the same time it would take to get to 80-90%. So you can see that this second phase [between 2020 and 2030] is where we get the most growth. We had retail adoption which brought [Bitcoin] to $1.2 trillion between 2010 and 2020, and then with institutional adoption, the 90% will come.”

What does a world with 90% Bitcoin adoption look like? Is there an inevitable collapse of the fiat system and Armageddon on the streets? Mark pauses and shakes his head.

“I think one big misconception is people think that for Bitcoin to get to $1 million [something Mark envisions cerca 2030] or $10 million per coin, then that means that fiat is worthless and now it’s $1 million for a gallon of gas, but that’s absolutely not true.”

A Readjustment of Store-of-Value Assets

He likens Bitcoin adoption to market disrupters like Uber and Airbnb saying,

“Airbnb takes a little bit from the hotels. It doesn’t mean hotels go away, just like Uber continues to get more and more from taxis. Bitcoin is not taking away from the dollar. Bitcoin is taking away from other store-of-value assets, like gold, equities, bonds, and real estate.”

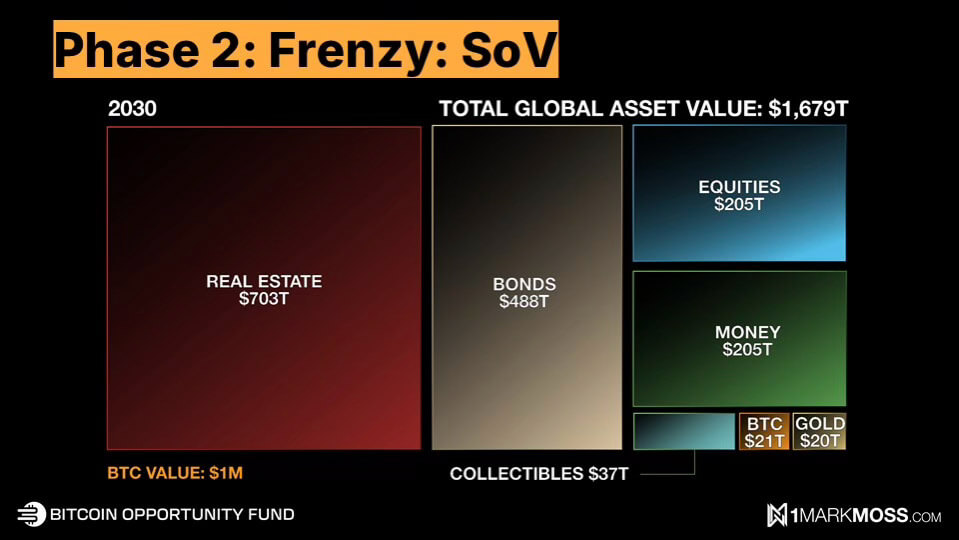

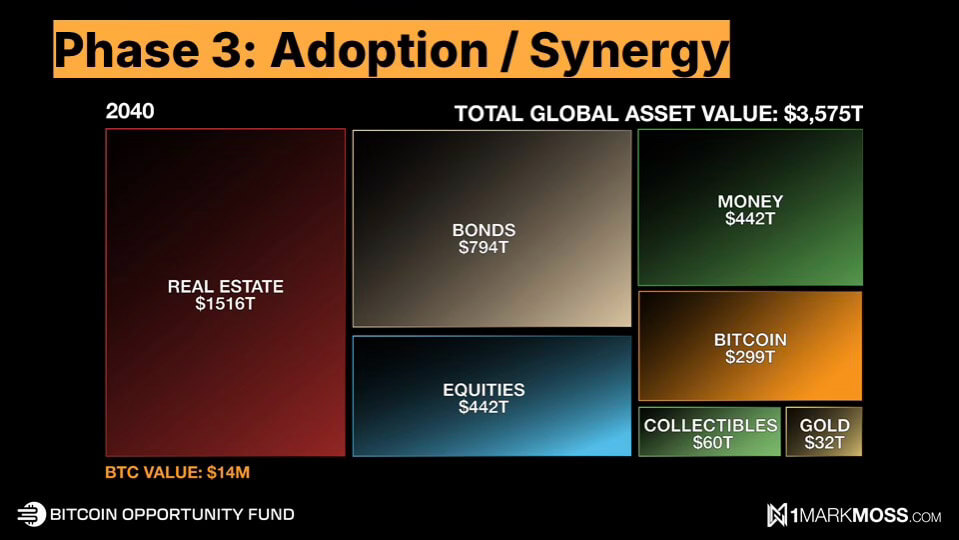

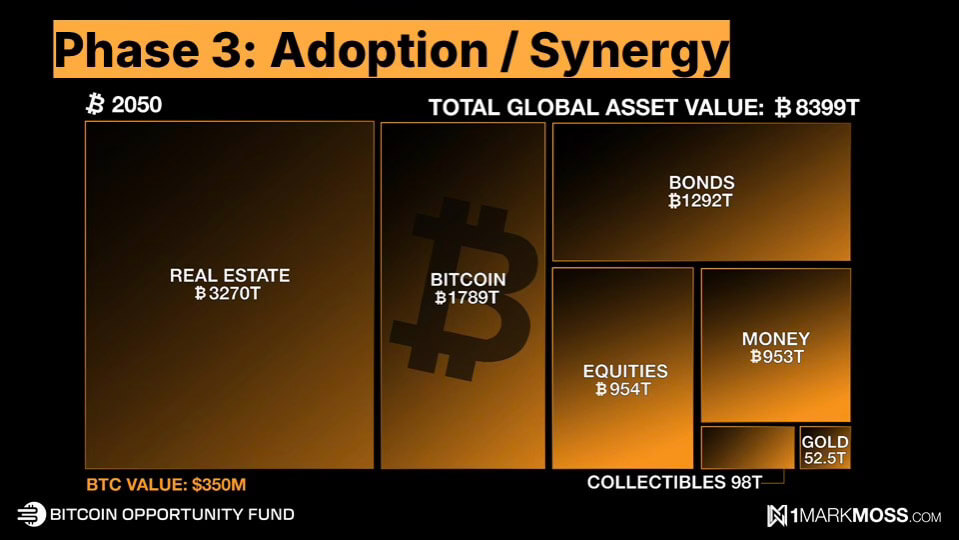

He pulls out three charts comparing Bitcoin to store-of-value assets as its price, size, and market cap grow.

“Bitcoin could grow to $21 trillion by 2030, which means $1 million per Bitcoin, but it doesn’t mean all these other assets go away. It’s on par with gold. It’s taking a little bit from bonds, a little bit from money, and a little bit from equities.”

“If we fast forward to 2050, Bitcoin becomes the second biggest asset class, but it doesn’t mean the other asset classes go away… By 2050, I believe all the store-of-value assets will be priced in Bitcoin instead of U.S. dollars, and then one Bitcoin will be worth one Bitcoin, instead of $100,000 or $1 million.”

He brings up Gresham’s law in his argument for the continued existence of the dollar.

“Gresham’s Law states that bad money drives out good money. So an example is in the United States, up to 1965, quarters and dimes were made of pure silver. After ‘65, they started making them out of junk metal. You can’t find a pre-65 quarter and dime in circulation anymore, and if you did, you wouldn’t spend it because it’s worth like $4. So you’d save it. The bad money drove out the good money, the pre-65s out. So I will always want to use fiat and store my Bitcoin.”

‘Good Times’ Ahead for Bitcoin

The incoming President’s son, Eric Trump, gave a keynote at the event, proclaiming to “absolutely love Bitcoin,” congratulating Bitcoiners on their vision, stating that “America has to lead the way in a digital revolution,” and describing the moment he called his father at 6 am on the day Bitcoin hit $100,000, leading to the now-infamous “You’re welcome” post on Truth Social. So, does Mark expect a golden age ahead for Bitcoin in the United States? Will we see a resurgence of innovation and a return of the talent that bled out to other jurisdictions during previous administrations?

“The new administration will definitely be bullish for the industry,” he states. “It’s not really that Bitcoin that was on the ballot. What was really on the ballot was freedom. The freedom to choose how you want to store your money, and how you want to transact your money.”

He sees Trump creating a “much friendlier” environment for businesses but doesn’t envision a mass return of the companies that left. “Once you’re gone, you’re kind of gone. Why would you come back?” he asks. “But maybe we’ll slow down the companies that are leaving and maybe more will stay.”

What about a national strategic reserve in Bitcoin igniting global Bitcoin game theory? He believes the chances are as high as 80%.

“I mean, RFK said he would do it and he’s now in the Trump administration. Trump said he would do it. We have a red Republican House, Senate, and Presidency, and we already have the bill that’s been submitted by Senator Lummis. It just has to be approved. Maybe it fails and they’ll resubmit, but I would say in the next 24 months that goes through.”

Another prediction Mark has for the next 24 months is that U.S. banking institutions will start custodying Bitcoin, selling Bitcoin, and offering Bitcoin products.

“Last year the banks tried to overturn an SEC rule called SAV21, which prevents banks from being able to custody Bitcoin. It got to President Biden and he vetoed it. So we know they want to. They already tried to overturn it and Biden vetoed it. I’m guessing as soon as Trump takes over they’ll resubmit it and it will get approved… it’s good times,” he beams, “I’m optimistic. I’m very optimistic.”

If you want to hear more about Mark’s vision for Bitcoin and its phases of global adoption, you can follow him on X, catch his keynote from Bitcoin MENA, or watch his educational videos on his YouTube channel.

The post Mark Moss on Bitcoin adoption, freedom, and $1M Bitcoin appeared first on CryptoSlate.